Take advantage of extra thermal energy and waste as alternative fuels!

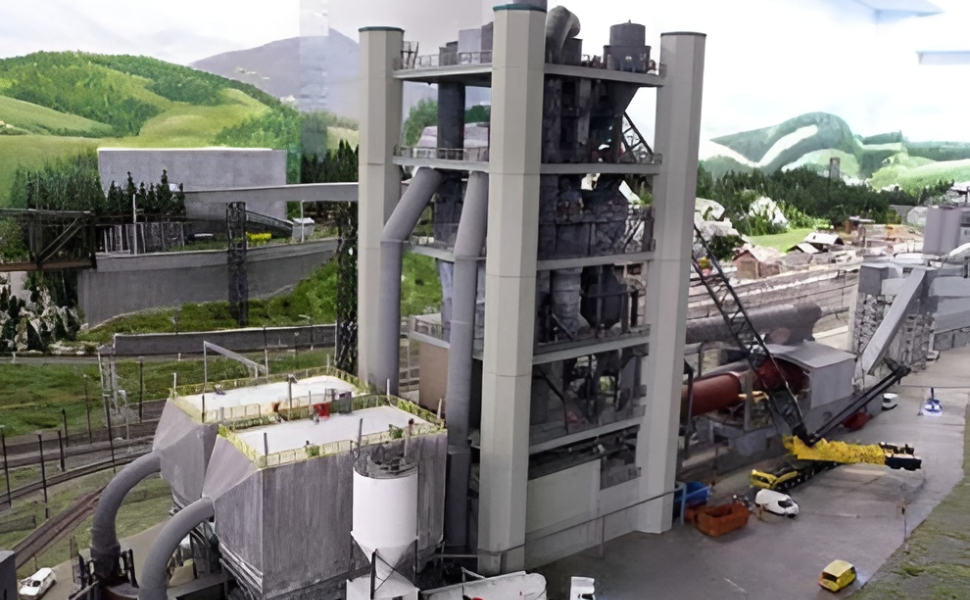

Cement is a fuel-intensive business, and with power and coal prices expected to climb in 2019, cement companies must investigate ways to save energy by using extra heat or burning waste to create electricity and boosting the usage of fly ash.

According to a leader, prior to "Softer" power costs, schemes to use surplus heat or burn garbage received little attention from enterprises. If we consider the efficiency of copper capital utilisation, the surplus heat system investment may be more efficient. However, when power rates climb, we must strike a balance to keep up.

"Sharks" throughout the world employ 10-17% alternative fuels for production. Holcim Vietnam and VICEM are pioneering the use of technologies to convert excess heat into power. Holcim Vietnam has used up to 14% of alternative fuels (waste, plastic, waste oil, and garment waste).

As VICEM General Director Bui Hong Minh, VICEM is researching and implementing a waste heat recovery project and testing waste incineration to protect the environment. Binh Phuoc crushing station is testing directly to burning. After completing the test, it will be widely researched and deployed.

Enterprises will be more proactive in production because they remain stable and long-term fuel sources.

Experts urge that owing to rising coal prices, Vietnamese cement firms transition to alternate fuel sources as soon as possible in order to cut production expenses. To enable the cement industry to expand more sustainably and with cleaner output, environmental challenges must be prioritised over economic concerns.

The cement industry is currently under pressure since the country presently has 29 capacity lines ranging from 250,000 to 600,000 tons per year, for a total capacity of 11.49 million tons, or 11.76% of total design capacity. These are chains that have been in operation for more than 15 years, with old equipment, excessive fuel consumption, higher prices, and low competitiveness; some companies even have to buy clinkers to grind cement. There are 13 lines with a capacity of 910,000 tonnes per year, for a total of 11.83 million tons, or 12.12% of the design capacity. Although these lines employ cutting-edge technology, manufacturing costs remain high due to high fuel consumption and low competitiveness.

In an age of intense competition in quality, service, and price, lines with limited capacity, massive costs, and excess pricing will need help to compete in the market. Small-scale cement plants will be forced to cease production during the elimination stage since they are unable to compete automatically.

To lower costs, raise competitiveness, and improve product quality, Vietnam's cement sector will develop companies, major cement businesses, and contemporary technology by global cement market regulations.

Vietnam cement currently has 20 major lines with a capacity of 2.3 million tons/year or more, for a total capacity of 26.2 million tons, which is in line with modern technology in the world today; consumption is whole, fuel is low, and has invested in synchronous installation of the system to use the Kiln's heat exhaust gas to generate electricity, saving 20-30% of total electricity used.

Source: ximang.vn